October 2009

Mid-Atlantic Deal Review

Trial Edition from Chessiecap, Inc.

Editor’s Note: Welcome to the 2nd Edition of the Mid-Atlantic Deal Review, a monthly review of transaction activity in the D.C.-Maryland-Virginia-West Virginia region. This edition is a Free Trial, which we hope will begin to add great value to your work and knowledge of the region. Our goal is to measure actual transaction activity and get beneath the surface of deals, news and trends.

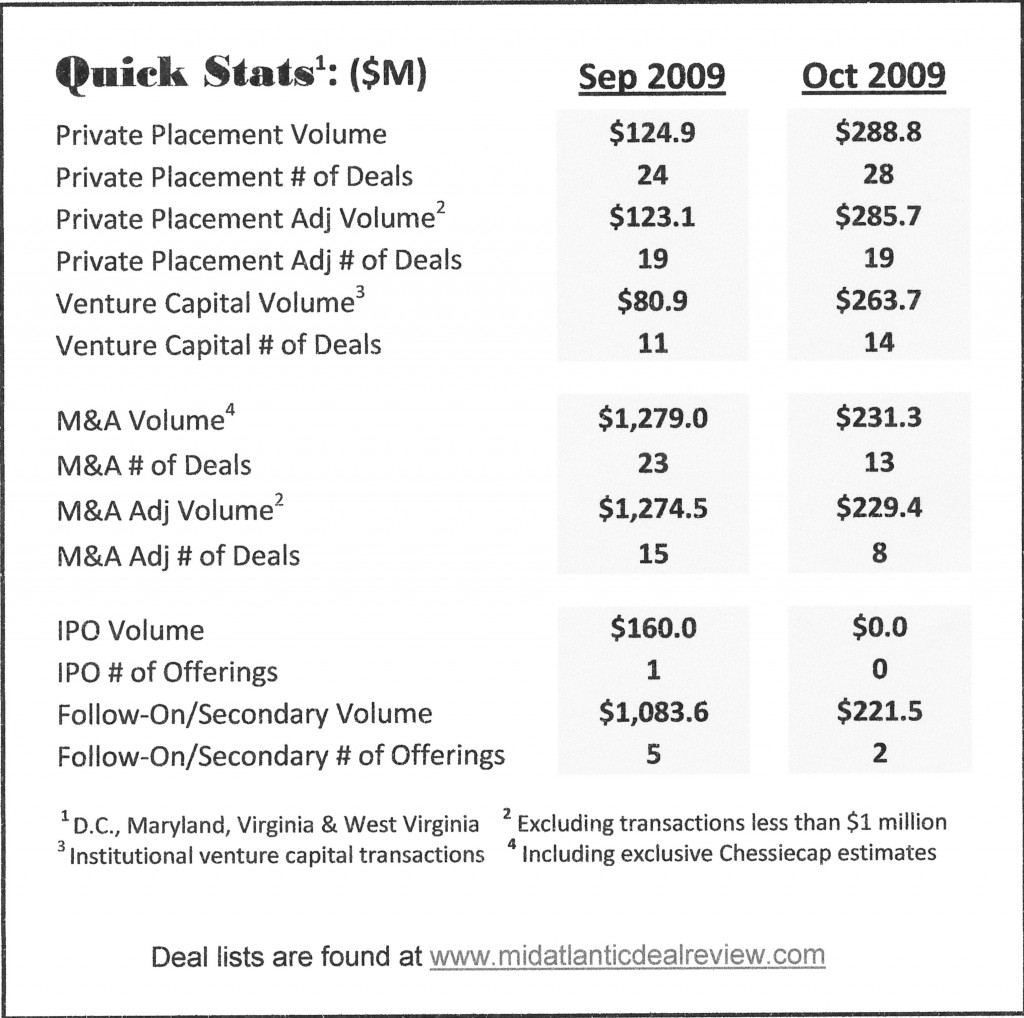

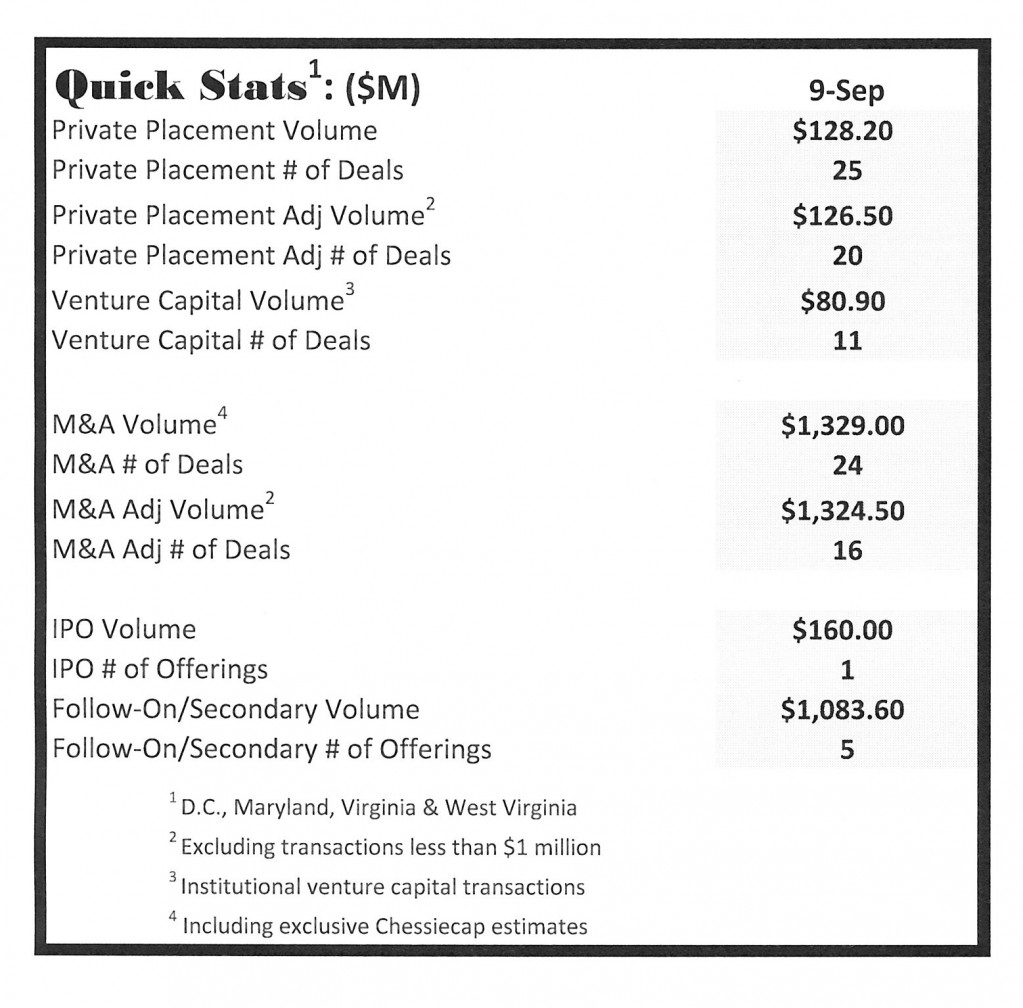

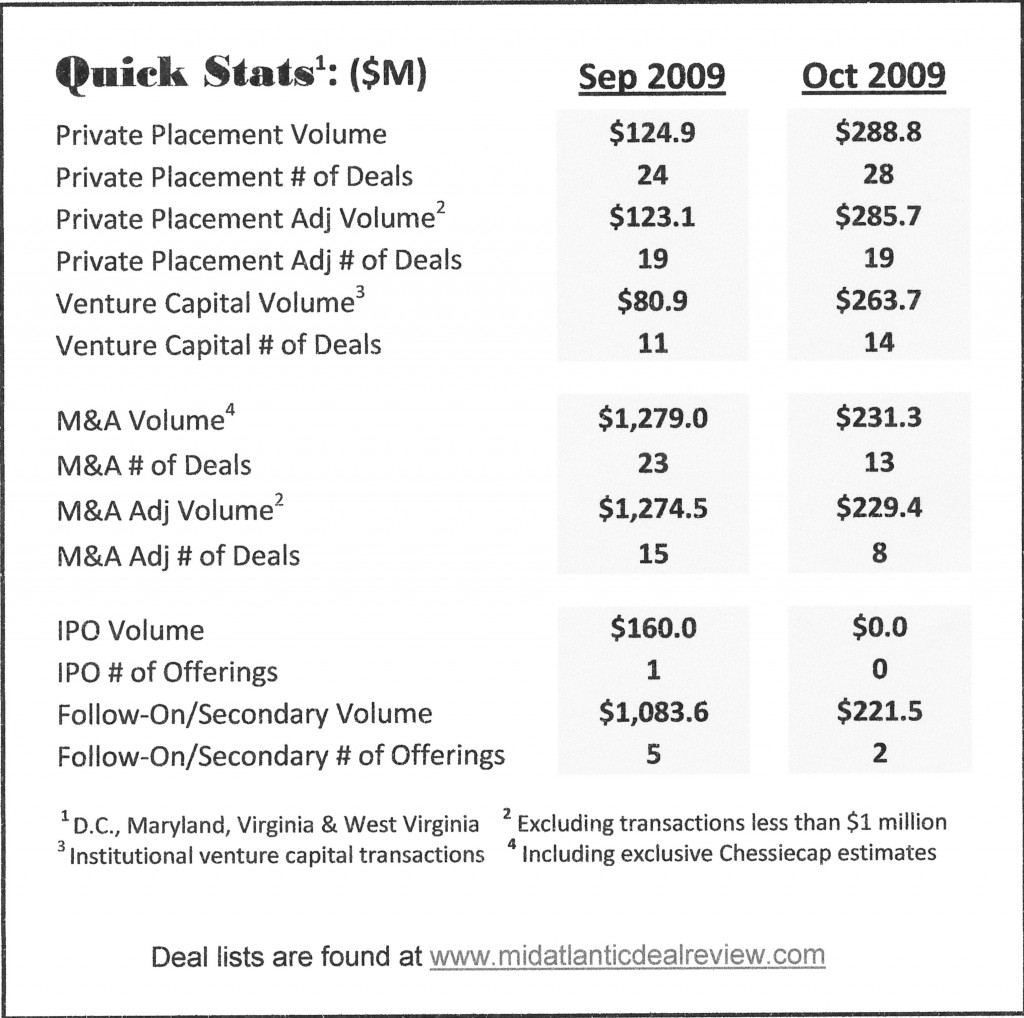

Quick Stats is the most comprehensive and thoroughly researched presentation of Mid-Atlantic transaction data available. Mid-Atlantic is defined as D.C., Virginia, Maryland and West Virginia. Private placements include all private equity investment including institutional equity, PIPEs, private investors and other forms of new investment. The M&A data are the first to capture true regional activity. Over 2/3 of all M&A transactions are “undisclosed,” resulting in almost meaningless totals. Chessiecap reviews all reported regional transactions and uses its market knowledge and deal intelligence to assign probable deal values. The data above does not capture debt transactions, recapitalizations, non-corporate real estate financings (project financing) or purchases by local companies of companies outside this region. The primary filter is the addition or transfer of value into or within the region at the corporate level.